About Jason Sherman

Innovator, Filmmaker, Author, Tech Expert

Jason Sherman is a successful innovator, award winning filmmaker, published author, tech startup expert, and has a background in journalism. He is the CEO and co-founder of B2B SaaS AI Agent platform Vengo AI. He previously co-founded popular video friendship app Spinnr. Jason has been featured by several media outlets including the Wall Street Journal, USA Today, The Verge, The Philadelphia Inquirer, ABC, CBS, NBC news, and many more. He is fluent in Spanish, is a classically trained violinist, and was a featured speaker on FOX's Emmy award winning Futurist TV Show: Xploration Earth 2050.

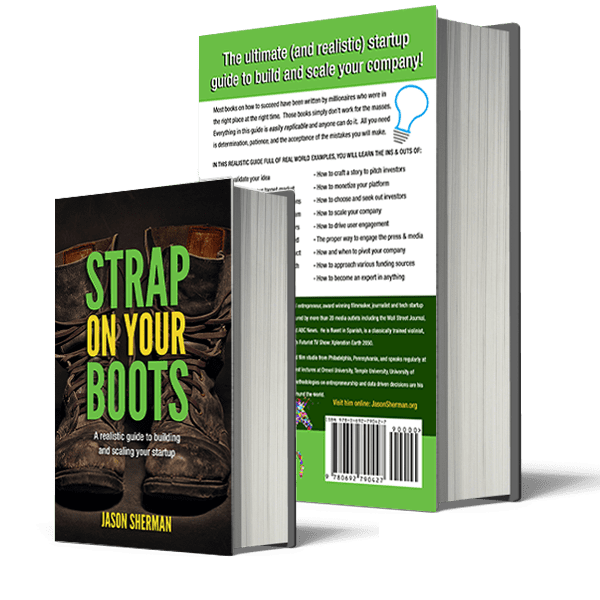

Jason runs a web and mobile dev shop and award winning film studio from Bucks County, Pennsylvania. He gives guest lectures at area universities, and regularly supports hackathons or tech events as a mentor and judge. His methodologies on entrepreneurship and data driven decisions are his main source of education to those he helps all around the world. His startup book Strap on your Boots is the culmination of his life's work to help other entrepreneurs succeed, with a podcast of the same name, and is the focus of a course he created called Startup Essentials. He originally taught the course as a guest lecturer at area universities, including UPenn's Wharton School of Business, and now the course is available online for students on Udemy.